Welcome to The Seafarer Saver

A fully flexible savings solution for the seafarer community

We believe that the seafarer community should have the opportunity to invest their money in a smart and affordable way, but investment solutions are often out of their reach. We proudly challenge this with a straightforward online service enabling you to break down the barriers to the investment you deserve, and take full control of your financial wellbeing.

WHY US?

When it comes to the crunch, most of us want reliable and meaningful growth of our nest egg with the ability to access the money if required. It all sounds straightforward but is in fact very difficult when trying to achieve in the real world where bank savings accounts deliver so little.

Whether you are saving for your first house, your child’s

education, or to simply start building your nest egg, the TAM

Seafarer Saver may be the solution for you.

By investing as little as €1,000 a month, clients can build a

substantial investment enhanced by our professional management.

We provide you with direct access to TAM and its the award-winning investment team, TAM's experienced team manage the Seafarer Saver investments.

- Everything is clearly explained so lack of investment experience is no longer an obstacle.

- For only a few euros a month you can access a diversified fund run by some of the most successful investment managers in the world.

- The minimum investment is just €1,000 and you have the ability to withdraw your money at any time without penalty.

HOW IT WORKS

Six straightforward steps to start saving for your financial future

- Click through to the online investment tool

- Decide which fund is right for you

- Complete the short application process

- Choose to support Save the Med

- Add money to your new investment account

- Watch your nest egg grow

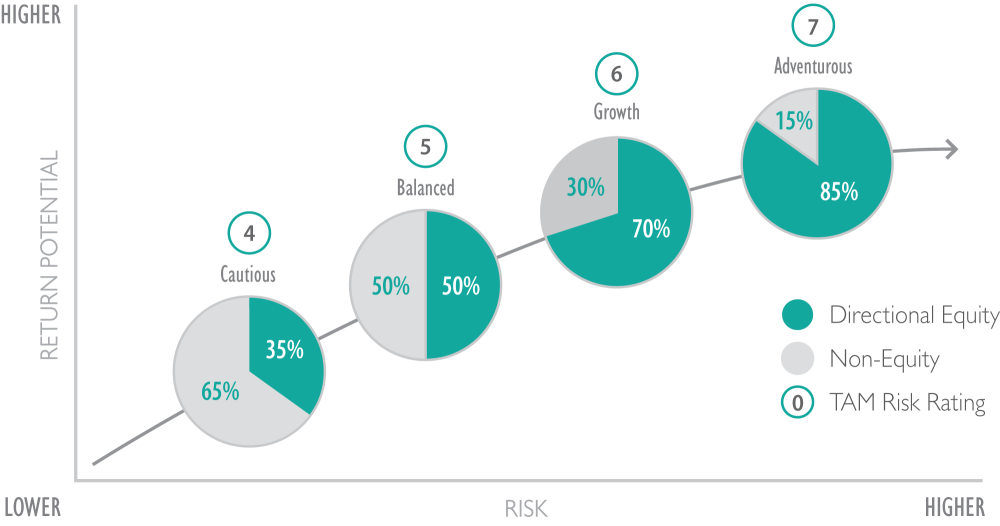

Variety of investment options

FOUR FUND CHOICES

We offer three fund choices to investors, depending on how much risk you are willing and able to take with your money. You can choose a Cautious, Balanced, Growth or Adventurous fund to invest in.

TWO ACCOUNT CHOICES

A General Investment Account (GIA) is an account for your general monies which can

be opened with as little as £1000. Your money can be accessed at any time but,

because investing should be seen as something to undertake for the longer term,

it is usually worth retaining some cash at the bank for those unforeseen little

emergencies.

A General Investment Account (GIA) is an account for your general monies which can

be opened with as little as £1000. Your money can be accessed at any time but,

because investing should be seen as something to undertake for the longer term,

it is usually worth retaining some cash at the bank for those unforeseen little

emergencies.

An Individual Savings Account (ISA) is an account available to UK residents where

gains on the first £20,000 can be taken free of tax (2020/21). Because of this

benefit there is an annual limit on the amount you can invest each year. With an

ISA you can withdraw your money at any time but you can’t then reinvest it if

you have already reached your individual limit.

An Individual Savings Account (ISA) is an account available to UK residents where

gains on the first £20,000 can be taken free of tax (2020/21). Because of this

benefit there is an annual limit on the amount you can invest each year. With an

ISA you can withdraw your money at any time but you can’t then reinvest it if

you have already reached your individual limit.

THREE CURRENCY CHOICES

![]() Investors can choose to open an account in pounds, euros or dollars.

Investors can choose to open an account in pounds, euros or dollars.

Flexible payment terms

- Our plan gives savers the freedom to choose how and when they make their investments.

- Payments can be made directly via bank transfer or standing order.

- In addition to regular monthly investments, clients can choose to invest lump sums at any time.

- They can also access their investment or take a payment holiday at any time, without penalty.

Performance

Launched in 2020, the Seafarer Saver performance here is a simulation of the return each fund would have gained, had it been held from 1st January 2015.

Source: TAM Asset Management. TAM Seafarer Saver fund return from 1st January 2015 to 31st December 2019 net of TAM fees. Figures quoted are simulated for illustrative purposes only, they are pro forma based on the assumption that the fund was held from 1st January 2015. Past simulated performance is not necessarily a guide to future returns. The value of investments, and the income from it, may go down as well as up and may fall below the amount initially invested.Charitable giving

TAM Seafarer clients can participate in our pioneering You Give We Give initiative:

YOU GIVE

The client can choose to donate up to 20% of their annual investment profit to Save The Med

WE GIVE

TAM will donate the same percentage from our total annual fee from managing their investment

Miss Johnson chooses to give10% of her investment profit to Save The Med:

- Portfolio Value 1st Jan £100,000

- Portfolio Value 31st Dec £105,000

- Annual Gain £5,000*

You Give We Give 10% of profit:

- Charitable Donation £500 plus 10% from our annual fee

*Illustration only, past performance is not a guide for future returns

The power of regular saving

Possible Monthly Investments

YEAR |

3% GROWTH |

5% GROWTH |

7% GROWTH |

|---|---|---|---|

| 3 | 37,621 | 38,753 | 39,930 |

| 5 | 64,647 | 68,006 | 71,593 |

| 7 | 93,342 | 100,329 | 107,999 |

| 10 | 139,741 | 155,282 | 173,085 |

| 15 | 226,973 | 267,289 | 316,962 |

| 20 | 328,302 | 411,034 | 520,927 |

| 25 | 446,008 | 595,510 | 810,072 |

The financial markets do not always offer a smooth ride but investing regularly each month allows savers to build up their investments and can help to smooth out fluctuations over time.

For example, the illustration on the left shows how a monthly investment of €1,000 can grow when we assume certain growth rates.

The growth rates used in this report are purely for illustrative purposes and are not guaranteed. The actual growth rate will depend on the investment option selected and the performance of the underlying funds. Performance of the underlying funds is not guaranteed and your investment return may be lower than the contributions paid into the plan.The illustrative investment values have been calculated assuming growth rates of 3.00%, 5.00% and 7.00% per annum. The three rates of return do not allow for annual management fees therefore higher gross rates of return have been used for the illustration. The three rates of return are purely for illustrative purposes and do not represent upper or lower limits on the investment performance.

How we invest

Protecting your capital

The best way to build wealth is not to lose it in the first place. Producing reliable annual performance and then compounding through reinvestment provides stronger and more consistent growth for your nest egg. For example, if you make 5% per year and re-invest, then after 9 years your portfolio is over 50% larger and in 15 years it has doubled.

MANAGING RISK LEVELS IN THE PORTFOLIOS

Portfolios are meticulously built and managed to ensure they

remain aligned with TAM’s views on possible market changes and

the economic outlook. Each individual fund is selected by TAM in

context of the choice of portfolio you make during the initial

account opening process.

DIVERSIFYING TO PROTECT YOUR NEST EGG

The funds in each portfolio are diversified by geography,

sector, asset class, fund manager, currency and investment

strategy. Each fund in a portfolio will invest in numerous

assets such as individual company stocks or bonds. The aim is

always to blend together investments that do not all do the same

thing at the same time especially during periods of market

stress

PUTTING INVESTMENT TALENT TO WORK

Seafarer Saver’s chosen investment manager TAM has 100%

independence to select funds from any provider that meet their

research and due-diligence criteria. TAM’s award-winning

experience enables you to access a blend of some of the best

investment talent from a cost of only a few pounds a month.

ACCESS TO YOUR MONEY IF YOUR CIRCUMSTANCES CHANGE

An investment portfolio should be looked at as a three to five

year process as a minimum. However we understand that life

happens and if you need to access your funds we charge no exit

fees or lock-in periods.

In the main, the portfolios invest in liquid markets where the fund’s assets can be bought and sold easily even during periods of market turmoil. However, the investment managers will access funds that invest in less liquid assets such as property when they deem it appropriate.

Complete transparency

24/7 ACCOUNT ACCESS

Our TAM platform offers 24-hour access to clients and their

advisers. It allows instant consolidation of all your investments,

real-time portfolio valuations, detailed analysis of investments,

performance measurement and details of asset exposure.

BESPOKE REPORTS

You can obtain instant exposure analysis and asset allocation

modelling information for every portfolio. Once logged into our

secure website, you can access the exceptionally fast and

efficient management reporting tools available.

Our investment platform allows for immediate and comprehensive

internet based valuations, the “reasons why” each investment

decision was made and urgent commentary – all in a comprehensive

and understandable format.

With a few clicks it is possible to draw a full management

report and have it delivered as a .pdf file instantly. This

reporting package allows for you to choose the dates and style of

your report and it is all available at the touch of a button.

Fees & Rewards

TAM and Partner FEES

Ongoing charge

0.98% per annum for the life of the investment

The charges comprises of the TAM Annual Management Charge (AMC) of 0.65%, and the Partner servicing and administration costs of 0.33% per annum.

REWARDS

Over €1,000 per month contribution

3 months free from TAM AMC (0.65%)

APPLY FOR AN ACCOUNT

So how do I open a seafarer account?

The attached video outlines the process by which you can open your account. You can go direct to open one without viewing this... but this does outline the process for you if you want to know a little more. If you stick with it you will get the full picture and see that it is not that complicated as we have made the process for opening an account as easy as possible.

Remember, if you do open an account you have both full transparency and the ability to close or withdraw money without penalty at any time, and you could even help Save the Med.....if you so choose.

Join the savings revolution and build for the future